sage software share price

Overview

You’re not the only one keeping tabs on the share price of The sage software share price. Market observers, analysts, and investors are keeping an eye on the company’s performance and potential future developments. In order to help you understand what is driving the stock, what the risks are, and whether there may be upside ahead, we will examine the sage software share price today as well as the most recent market trends and insights. This is your approachable, easily reading guide to software stocks, regardless of your level of experience as an investor.

We will discuss important topics like:

- Current snapshot of the share price

- Current performance and background

- Important factors influencing the share price of sage software share price

- Market developments affecting Sage and its competitors

- sage software share price examination of SWOT (strengths, weaknesses, opportunities, and threats)

- Forecast and projection for the share price by analysts

- FAQs you may have

- And a summary with key conclusions

Let’s get started.

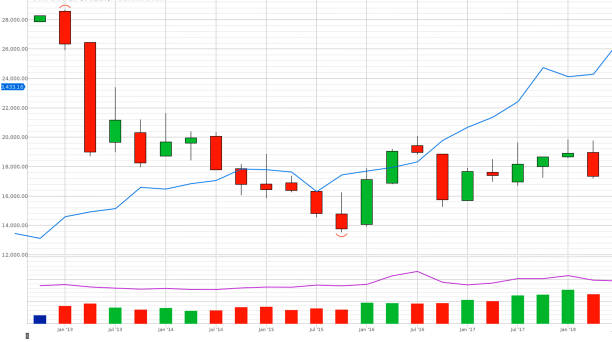

A snapshot of the current share price

First, an overview of the share price of Pascal Software as of right now:

- On the stock market in London, it is traded under the symbol SGE.

- Recent data indicates that during latest trading sessions, the share price was approximately 1,130 GBp (pence).

- Around 960 GBp (low) to 1,349 pounds (high) is the 52-week range.

- Metrics: According current sources, the market cap is approximately £10.8 billion, and the P/E ratio is between thirty percent and thirty-five times, depending on earnings.

So in today’s context, the Sage Software share price is trading in a mature range, with upside potential but also some headwinds.

Current Performance and Historical Background

Looking back a little is necessary to comprehend where the shares of Sage Software share price is at the moment:

Past Results

- Sage’s stock went from a low of about 960 GBp to highs of over 1,349 GBp in the past year.

- Performance has been mediocre at that time, with growth in the single to low double digits. One note, for instance, displays roughly +10.86% over a 12-month period.

- When estimating future share price potential, this company has been moving more and more toward cloud, subscription software, and recurring income models.

Why That Is Important

- Investor expectations change with shares move; generally speaking, a robust rate of revenue and earnings growth supports share price appreciation.

- Conversely, a share price may stagnate or drop if macroeconomic headwinds (such as inflation or higher mortgage rates) bite or growth slows.

In summary: the market is pricing in both potential and risk, and the share price of Sage Software nowadays represents a company in transition – from conventional programs toward cloud/subscriptions.

Important Factors Affecting the Share Price of Sage Software Today

Let’s examine the elements that are influencing the share price of Sage Software today and what you should be watching.

1. Transition to recurring revenue and the cloud

- Sage has been growing its subscription services and cloud-based offerings, which investors find appealing as they produce steady revenue.

- The stock frequently reacts by revaluing (sometimes higher) as the business model changes from one-time licenses to ongoing income.

2. Cash flow, margins, and profitability

- Sage reported net revenue of approximately £2.33 billion (up approximately 6.8% year-over-year) and net income of approximately £323 million for the fiscal year that ended in September 2024.

- Businesses with robust cash flows, excellent operating margins, and effective cost control are preferred by investors; these factors all contribute to the current share price of Sage Software.

3. Interest rates and the macroenvironment - Even well-established software firms like Sage are susceptible to macro threats. Growth expectations can be lowered by higher prices, economic slowdowns, and rising interest rates.

- Future profits are more highly discounted in a higher-rate environment, which may have an impact on share price.

4. Innovation and competition, particularly in AI

- There is severe rivalry in the software industry. Sage must continue to lead the way in cloud, analytics, artificially intelligent technology, and business management solutions.

- Any lag in comparison to rivals may stifle investor excitement. Sage has “allowed its rivals to take a technological lead,” according to one piece, which also hinted at the necessity of investing in AI.

- The share price of Sage Computer will react to announcements about AI, product upgrades, or major acquisitions since positive advances are rewarded.

5. Capital allocation, dividends, and share buybacks - Signals of sound capital deployment frequently increase share price. For instance, the stock increased once Sage announced a big repurchase or something like.

- Dividends are important: Sage now yields between 1.8 and 2%.

6. Geographic and regional expansion, particularly in North America

- North America is Sage’s fastest-growing market, and it frequently asks a higher price.

- Expectations for the performance of the global share price can be raised by strong growth in a crucial region.

Market Trends Affecting Peer Stocks and Sage Software

You must also look at what’s happening in the larger market and industry in order to totally understand the price of Sage Software’s shares today.

Trend: Dominance of cloud or SaaS

Businesses are still gravitating on software-as-a-service (SaaS), cloud computing, etc subscriptions. If done correctly, that trend benefits businesses like Sage.

The bar is raised by the numerous competitors, pricing pressure, and increased growth expectations triggered by this trend.

Trend: Adoption of AI with digital transformation

Organizations are spending money on AI, tool upgrades, and operational digitization. Sage’s flexibility to include automation or artificial intelligence capabilities may set it apart.

In comparison to more aggressive opponents, Sage’s share price may decline if it is perceived as following or overly conservative.

Trend: IT budgets and economic uncertainty

Firms could decrease what they spend on new software or postpone upgrades as economic growth slows. That could influence a shares price and slow growth.

Trend: Pressures on appraisal

Many computer and software stocks are subject to value scrutiny in developed markets; investors wonder if growth is already priced in. The share price may not rise much more if the business is established and its growth is slow.

According to Sage’s current P/E (30–35x), growth expectations are already present. The share price may be at risk if growth is subpar.

Trend: exposures to FX and the UK

Since Sage is a UK-based business, changes in the GBP/US dollar exchange rate as well as local economic conditions could have an effect on its profits.

Today’s Sage Software share price could be impacted by any downturn in the UK economy or GBP.

SWOT Analysis: Current Share Price of Sage Software

Let’s review using a strategy analysis, which looks at the company’s advantages, disadvantages, chances, and dangers in relation to the current market price of Sage Software.

Advantages

- well-known brand and a large global clientele of small and mid-sized firms.

- transition to cloud and subscription models, which increase income visibility.

- Strong capital allocation (buybacks and dividends) and cash flow generation are increasing confidence among investors.

- Growth is good in important areas like the United States.

Limitations

- In comparison with high-growth technology firms, the growth rate is moderate, which could limit share price potential.

- pressure to compete from both more recent cloud/SaaS firms and more established software vendors.

- Due to its relative maturity, the company might not experience the rapid growth as popular tech stocks do, which would make the share price more susceptible to setbacks.

Prospects - A larger percentage of the price could be justified and new growth avenues opened by the SME market’s increased embrace of AI and automation.

- Incremental growth may be fueled by new product introductions, strategic acquisitions, and more regional expansion.

- The share price may rise if investors re-rate the shares higher (i.e., greater multiple) if the company performs well.

Dangers

- The share price of Sage can drop if the economy slows down or if businesses spend less.

- Profitability may be impacted by global headwinds, regulatory changes (particularly in the UK and European), or changes in currencies.

- Sage might see margin pressure if opponents outperform it on price or innovation, which would hurt the share price.

In conclusion, the current price of Sage Software company shares represents a business with strong foundations, modest growth, and both upside and negative potential; execution and general market mood will probably determine the company’s future course of action.

Frequently Asked queries or FAQs

The following are some frequently asked questions (together with their responses) regarding the current share price of Sage Software:

Q1: What is the current share price of Sage Software right now?

A: According to the most latest data available, Sage Group plc’s (ticker SGE) price per share is approximately 1,130 British pounds. Note: there may be a small delay in the market data.

Q2: How much has the share cost for Sage Technologies moved over the past 52 weeks?

A: The 52-week high is close to 1,349 GBp, while the low for the past 52 weeks is about 960 GBp.

Q3: Is a dividend paid by Sage?

A: Sage does pay dividends. Given the present price levels, the recent yield is between 1.8 and 2%.

Q4: What are the most significant dangers of making an investment in Sage right now?

A: Risks include slower growth, more competition, margin pressure, macroeconomic weakness that lowers software investment, and exposures specific to the UK and its currency.

Q5: Is it possible for the share price of Sage Software to rise significantly today?

A: Possibly, if the business grows in important markets and does a good job with cloud growth and AI projects. However, given a large portion of the business is currently priced in, the upside might be limited absent a powerful positive catalyst.

Q6: Is Sage now undervalued?

A: That relies on how you envision future development. According to the value (P/E ~30-35x), the stock market anticipates modest growth. It might be well valued or even overvalued if you think growth will slow down, and it might be valued if you think it will accelerate.

In conclusion

In conclusion, the current share price of sage software share price a well-established, internationally recognized software business with strong foundations, consistent growth, and reasonable investor expectations. The 52-week range of the stock is between ~960 and 1,349 GBp, with a trading range of approximately 1,100 to 1,300 GBp.

What this implies for you:

- Sage is a desirable software investment if you’re searching for something comparatively reliable with dividend income and a global presence.

- Because of its less noteworthy growth, Sage could not provide the explosive potential you’re looking for in high-growth tech firms.

Effective execution—strong subscription and cloud service revenue growth, successful - innovation, particularly AI, and favorable market conditions—will be vital for the share price’s upward trajectory.

- Conversely, the share price can fall or move sideways if software spending declines or competition heats up.

In short: sage software share price is reasonable, with room for upside if things go well—but not wildly speculative. For long-term investors who believe in Sage’s transition and global reach, it could be an interesting proposition. For those seeking rapid growth, it may not excite in the same way as younger, higher-growth software firms.

If you enjoyed this breakdown of the sage software share price– latest market trends and insights – feel free to bookmark this article and check back regularly for updates. Let me know if you’d like a deeper dive into valuation models, competitor comparisons, or how Sage fares against other software stocks.

Welcome to Techoway, your trusted source for all things technology! Whether you’re looking for the latest tech news, honest product reviews, how-to guides, or simplified explanations of complex topics, Techoway is here to keep you informed and inspired. We’re passionate about making technology easy to understand and accessible for everyone—because the future belongs to those who embrace it.