"Learn about the Chase max ATM withdrawal limit and how to withdraw cash safely and conveniently."

Accessing your money quickly shouldn’t be a hurdle when life happens. Whether you’re paying a contractor or traveling across the globe, understanding your Chase Max ATM Withdrawal Limit ensures you never get stuck at a machine with a declined request. This comprehensive guide breaks down exactly how to navigate Chase daily ATM limit rules in 2026 for both USA and UK account holders.

1. What Is the Chase Max ATM Withdrawal Limit?

The Chase Max ATM Withdrawal Limit is the highest dollar or pound amount you can pull from an automated teller machine in a 24-hour window. Banks implement these Chase ATM cash withdrawal rules primarily to protect your account from massive losses in case of theft. Most standard accounts have a default transactional threshold that keeps your personal finances secure while allowing for typical daily needs.

2. How Chase Max ATM Withdrawal Limits Work

The bank tracks your Chase daily ATM limit on a rolling 24-hour cycle rather than a calendar day. If you reach your Chase ATM cash limit at 10:00 PM, you must wait until the same time the next night for a full reset. This automated system monitors debit card activity in real-time to prevent high-velocity fraud and protect your account balance.

| Feature | Standard Policy (USA) |

| Reset Cycle | Rolling 24 Hours |

| Standard Baseline | $500 – $1,000 |

| Tracking Method | Real-time digital monitoring |

3. Chase Max ATM Withdrawal Per Day Explained

Your Chase ATM limit per day acts as the primary ceiling for your cash access across all machines. For a basic Total Checking account, the maximum cash you can take from Chase ATM is typically $1,000 in the United States. In the UK, the daily cash withdrawal limit at Chase usually defaults to £500 to maintain a high level of fraud prevention.

4. Chase Max ATM Withdrawal Per Transaction

Even with a high daily cap, individual machines have a physical Chase ATM transaction limit due to bill capacity. Most ATMs can only dispense about 40 to 50 bills per session to prevent mechanical jams. This means you might need to perform multiple individual sessions to reach your total Chase ATM maximum withdrawal for the day.

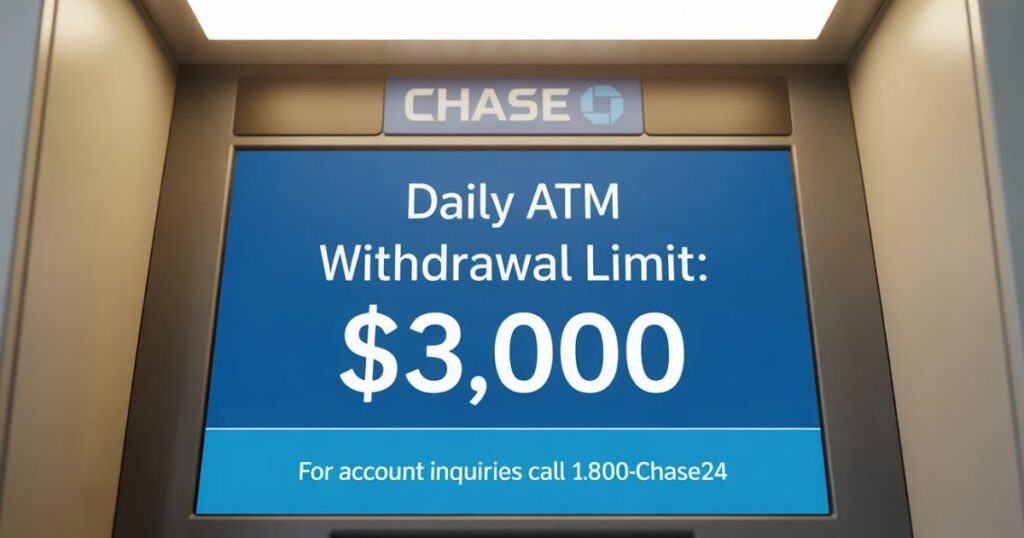

5. Chase Max ATM Withdrawal at Chase Bank ATMs

You often get the most generous Chase ATM cash access by using a machine located inside a physical branch. A Chase ATM withdrawal inside branch can allow you to take out as much as $3,000 in a single day. These in-branch terminals are more secure and frequently stock $100 bills for larger requests.

6. Chase Max ATM Withdrawal at Non-Chase ATMs

Venturing outside the official network usually lowers your Chase Max ATM Withdrawal Limit significantly. A Chase ATM withdrawal outside branch at a gas station or third-party bank might be capped as low as $500. This restriction is one of the key reasons Chase limits ATM withdrawals to reduce risk on out-of-network hardware.

7. Chase Max ATM Withdrawal for Debit Card Users

Standard Chase debit card ATM limit rules apply to most personal checking accounts. These limits provide a balance between convenience and safety for your everyday banking relationship. Most users find a Chase ATM maximum withdrawal of $1,000 is perfectly sufficient for their regular cash needs.

8. Chase Max ATM Withdrawal for Premium & Private Clients

High-tier accounts like Chase Private Client enjoy significantly elevated Chase ATM cash access privileges. These users often have a Chase Max ATM Withdrawal Limit of $3,000 as a standard perk. These premium banking tiers cater to individuals who manage larger volumes of liquid capital on a daily basis.

| Account Type | Daily ATM Limit (Est.) |

| Total Checking | $1,000 |

| Sapphire Checking | $2,000 |

| Private Client | $3,000 |

9. Chase Max ATM Withdrawal Using Cardless ATM Access

You can now access your money without a physical card by using a Chase ATM cardless cash withdrawal. Simply tap your smartphone on the machine’s NFC reader to initiate a Chase bank ATM withdrawal. The best part is that your Chase Max ATM Withdrawal Limit remains identical to your physical card limit.

10. Factors That Affect Your Chase Max ATM Withdrawal Limit

Several variables determine how much can you withdraw from a Chase ATM at any given time. Your account age, average daily balance, and credit history all influence your Chase daily ATM limit. The bank may temporarily lower your Chase ATM cash limit if they detect suspicious activity in a new location.

11. How to Check Your Chase Max ATM Withdrawal Limit

Finding your specific cap is easy if you log into the Chase mobile app or website. Navigate to your account details to see Chase ATM withdrawal limits explained specifically for your profile. You can see your daily remaining balance, which shows how much more you can take out before the next reset.

12. How to Increase Your Chase Max ATM Withdrawal Limit

If you need more flexibility, you can learn how to increase Chase ATM withdrawal limit through official channels. Visit a local branch to speak with a banker about raising your Chase ATM cash withdrawal ceiling permanently. They will review your banking history and income to see if you qualify for a higher daily allowance.

13. Temporary Increase Options for Chase Max ATM Withdrawal

You can also request a one-time boost for special events or major cash-only purchases. This temporary limit increase usually lasts for just 24 hours to help you with withdrawing large amounts of cash from Chase. Call customer service to verify your identity and request this short-term transactional adjustment.

14. Chase Max ATM Withdrawal Limits Inside Branch ATMs

Machines inside a bank lobby are the “gold standard” for getting the most cash possible. A Chase ATM withdrawal inside branch often unlocks the full $3,000 limit for eligible cardholders. These secure terminals are monitored by staff and offer the safest environment for your personal finances.

15. Chase Max ATM Withdrawal Limits Outside the U.S.

Traveling abroad changes your Chase ATM withdrawal rules and policies due to different currency laws. In the UK, the daily cash withdrawal limit at Chase is often £500, and there is a £1,500 monthly cap for international use. Always check exchange rates to see how much your money is actually worth in a foreign city.

16. Chase Max ATM Withdrawal Fees You Should Know

Understanding Chase ATM withdrawal fees explained helps you avoid unnecessary costs on your statement. While Chase machines are free, using a non-Chase ATM often costs $3.00 in the USA plus any surcharge fees from the owner. International withdrawals usually cost $5.00 plus a 3% foreign exchange adjustment fee.

| Fee Type | Amount |

| Chase ATM | $0 |

| Non-Chase (USA) | $3.00 |

| International | $5.00 + 3% |

17. Chase Max ATM Withdrawal vs Teller Withdrawal Limits

If the machine’s Chase ATM transaction limit isn’t enough, just go inside and see a human teller. There is technically no Chase Max ATM Withdrawal Limit for in-person withdrawals with a banker. Tellers can handle high-value transactions as long as you have the funds and valid identification.

18. What Happens When You Reach Your Chase Max ATM Withdrawal Limit?

The ATM will simply decline any further requests once you hit your daily allowance. This doesn’t mean your account is frozen; it just means your cash access is paused for that 24-hour cycle. You can still use your card for point-of-sale purchases at stores or online shops without any issues.

19. Smart Tips to Manage Your Chase Max ATM Withdrawal

Plan ahead by spreading large withdrawals over several days to stay under your Chase daily ATM limit. If you need $2,000, take out $1,000 on Monday and $1,000 on Tuesday to avoid hitting a block. This strategic financial management keeps your account safe while giving you the liquidity you need.

“A little bit of planning goes a long way. If you know you’ll need a large sum, start withdrawing a few days early to avoid hitting your daily ceiling.” — Financial Planning Expert.

20. Chase Max ATM Withdrawal Limits Compared to Other Banks

Chase stays very competitive with other major players like Bank of America or Wells Fargo. The Chase withdrawal limit Chase Bank offers for premium users is often higher than many local credit unions. Doing a market comparison ensures your bank matches your specific lifestyle and cash needs.

21. Common Problems With Chase Max ATM Withdrawal & Solutions

Sometimes a machine might have a technical glitch or run out of $20 bills. If you can’t get cash, try a different Chase bank ATM withdrawal at a another branch nearby. Most transactional errors can be solved by checking your app for a “fraud alert” and confirming the activity.

22. Chase Max ATM Withdrawal FAQs (Quick Answers)

How much can I withdraw from my Chase ATM per day?

Most standard accounts allow for up to $1,000 per day at a Chase machine. If you use an in-branch ATM, this Chase Max ATM Withdrawal Limit can increase to $3,000. Premium account holders like Private Clients often have higher default limits of $3,000 across the network.

Can I withdraw $1000 from ATM every day?

Yes, you can withdraw $1,000 every day as long as you have the available balance in your account. The Chase daily ATM limit resets every 24 hours on a rolling basis. This allows you to pull $1,000 daily for ongoing cash-heavy projects or travel needs.

Can I withdraw $5000 from a bank?

You can withdraw $5,000 from the bank by visiting a teller in person during regular business hours. While the Chase Max ATM Withdrawal Limit is usually lower, tellers can process much larger sums. It is helpful to call the branch ahead of time for such a large cash request.

How much can I withdraw from my Chase card?

Your total withdrawal depends on your specific Chase debit card ATM limit and account tier. Most basic checking accounts have a limit between $500 and $1,000 per day. You can view your exact Chase ATM cash withdrawal rules inside your mobile banking app settings.

What is the ATM withdrawal limit per day or 24 hours?

The Chase ATM limit per day is a rolling 24-hour cap on how much cash you can take out. This means if you withdraw money at 2 PM, the amount resets at 2 PM the following day. This system is a core part of the bank’s fraud prevention and security strategy.

How do I withdraw a large amount of money from Chase?

To withdraw a massive sum, your best option is to visit a branch and speak with a human teller. This bypasses the Chase Max ATM Withdrawal Limit and allows for customized high-value transactions. You can also request a temporary limit increase via the customer service phone line.

Can I withdraw $50,000 from Chase Bank?

Yes, you can withdraw $50,000, but you must do this in person at a branch with a teller. For such a massive cash withdrawal, you should notify the bank a few days in advance to ensure they have the cash. The Chase ATM maximum withdrawal is far too low for a request of this magnitude.

Can I withdraw $20,000 from a bank?

Withdrawing $20,000 is possible at any branch as long as you have the funds and proper ID. Because this is a large-scale withdrawal, you will need to sign extra paperwork and verify your identity. It is the safest way to handle withdrawing large amounts of cash from Chase.

How much can I take out of my Chase account per day?

At an ATM, the standard daily cap is usually $1,000, but in-person limits are much higher. There is no set daily limit for teller withdrawals as long as the branch has the cash on hand. Knowing your Chase ATM withdrawal rules and policies helps you decide the best way to get your money.

Welcome to Techoway – Your Trusted Technology Hub

At Techoway, we provide reliable insights into the world of technology. From the latest tech news and in-depth product reviews to practical how-to guides and simplified explanations of complex topics, our mission is to keep you informed, empowered, and inspired.

We are committed to making technology accessible and easy to understand for everyone, because the future belongs to those who embrace innovation with confidence.